Banks & Lenders

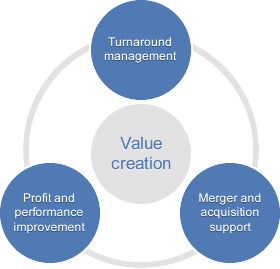

Banks face several problems for which we can provide an effective support.

Our goal is to reduce most of the associated risks for banks when doing business with companies as with:

- Existing debt. Lending risks for existing businesses, facing difficulties and asking for more credit to organize survival.

When a bank faces debt repayments of a customer, before thinking of a write-off, we can help the top management, under the bank’s recommendation, to provide support to stop the value destruction and provide opportunities to re-connect with a profitable situation.

We perform audits and assessments wherever needed (with staff, customers and suppliers) to identify quickly the problems. We will advise and support the management for a turnaround. We will identify quick operational wins and will help for crisis and insolvency management when needed.

- New debt. Lending risks for existing businesses doing well but needing cash to grow faster.

Our support helps to validate the Business Plan of the existing management or even to help them to identify more value creation possibilities to make sure the additional debt is well used to create additional value above the existing WACC.

We provide insights for market opportunities as well as for operational and strategy improvements.

We evaluate if investment plans are coherent and aligned with the targets set (not underestimated neither overestimated). We support their global expansion and evaluate and help those companies where alliances should be used instead of going for an expensive vertical or horizontal integration asking for lots of Capexes.

- New debt. Loans to finance an M&A for an existing customer of the bank.

Our operational due diligence allows for a better understanding of the correct acquisition price to pay and provides tangible top-and bottom line improvements to be implemented immediately after closing the deal.

Our actions will mainly focus on the Operational and Strategic due diligence for identifying short term value improvement potential (i.e. based on Lean manufacturing, footprint optimisation,…) but also on the evaluation of marketing and sales potential (access to new markets, bundling several products and services, pricing strategy, sources to create and capture more value added with customer base, ..).

Finally we can help with the assessment of management teams and leadership capabilities from a CEO point of view as well as the organisational capability of the targeted organisation (People and systems in place).